Reserve your place on one of our 3-day online courses

Course types

Our interactive courses are ideal for collections and recoveries professionals working in frontline roles within financial services organisations that offer mortgage products (both BSA members and non-members are welcome). There are two options to choose from:

- 3-day online open courses - these are delivered four times a year (dates below) - visit the BSA's website for more information or to book

- Bespoke courses tailored to your organisation - these can be delivered at any time throughout the year, either online or onsite - contact us for more information

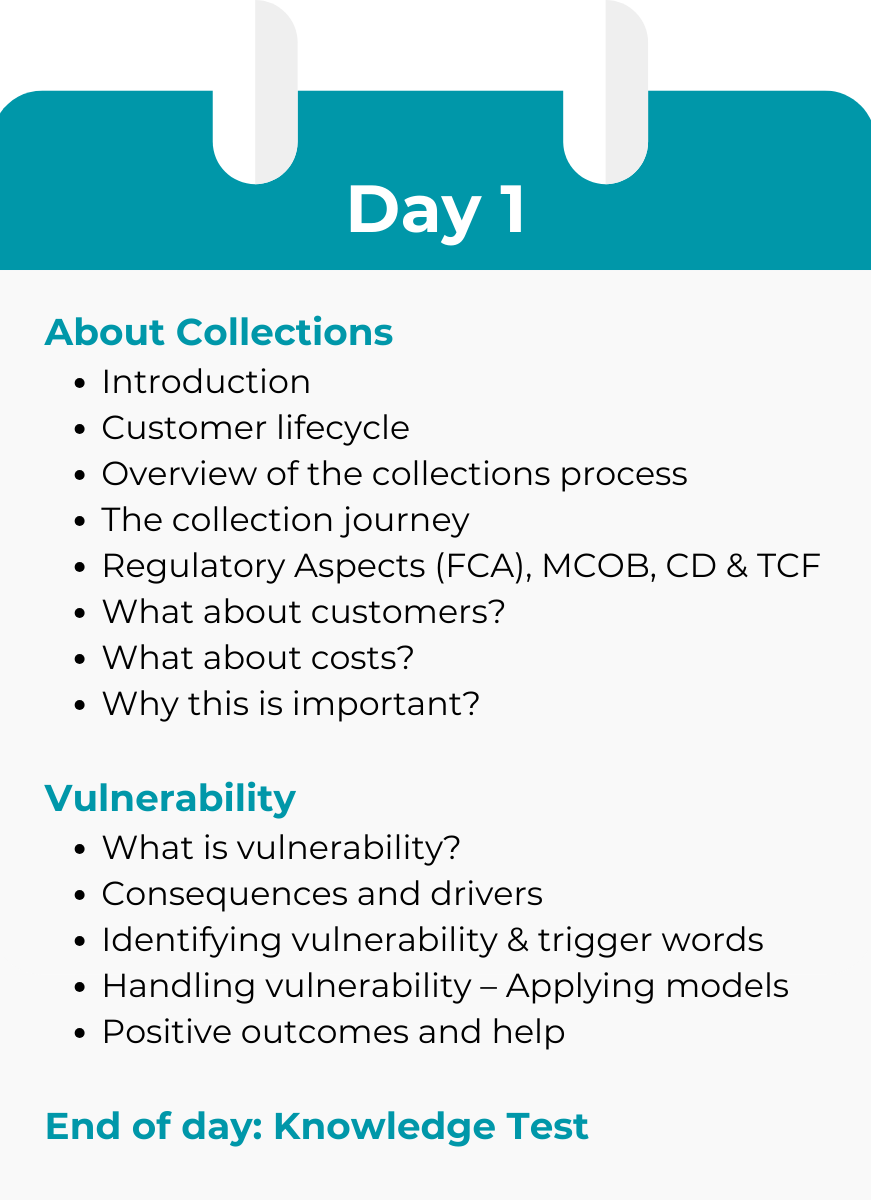

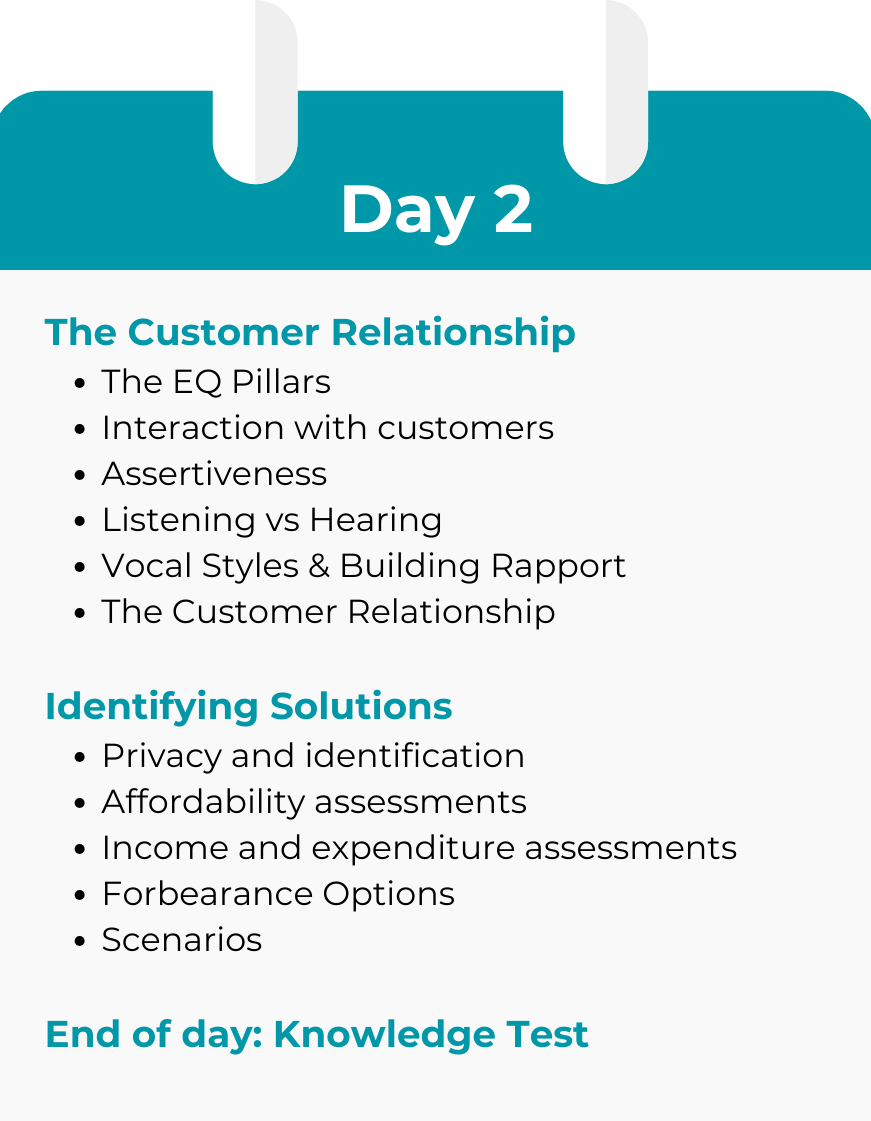

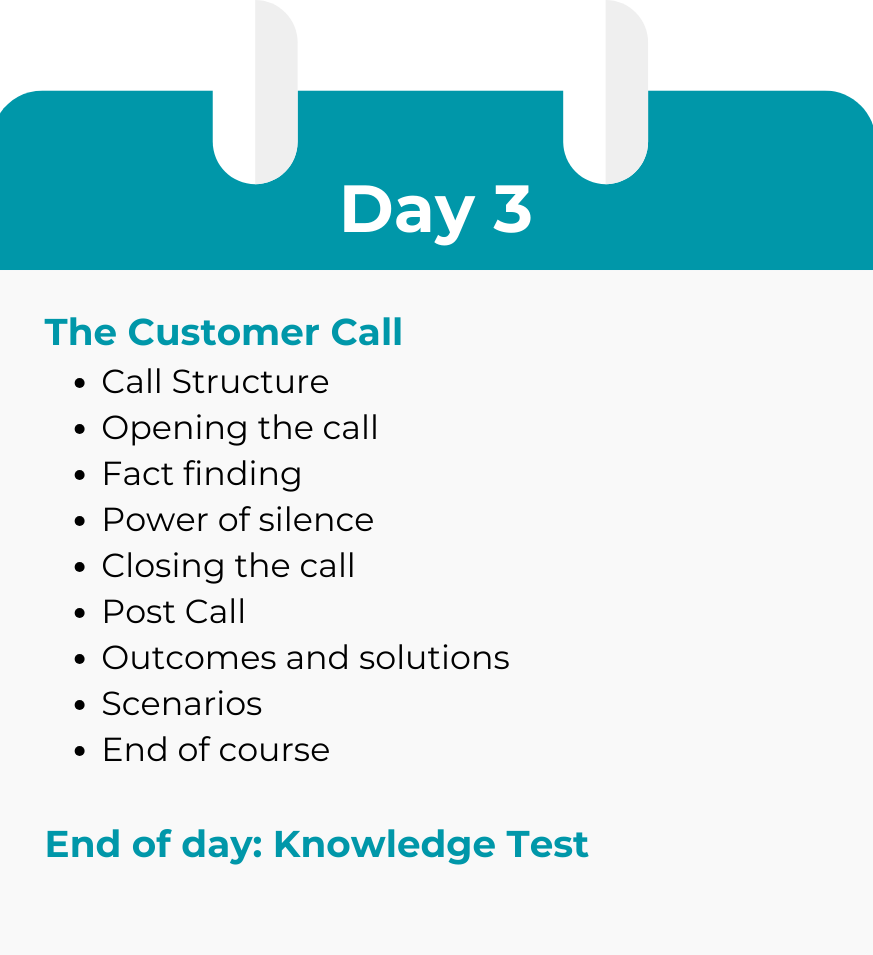

Course content

The 3-day course is a comprehensive, interactive, and BSA-accredited set of modules covering all aspects of dealing with customers within the regulated arena of mortgage products and services. Each day ends with a knowledge test which attendees must pass to receive their certification.

Course outcomes

The learning outcomes requested by members and included within the course include:

Course benefits

For course attendees

|

For managers and learning teams

|

- Gain a BSA and Arum Approved Certification

- Learn the latest agent best practice, industry insights and regulatory information

|

- Ensure your agents get the best outcomes for your customers

- Adhere to the latest regulatory changes

- Develop and retain staff

- Benefit from Arum's 25 years' experience in collections

- Help to raise industry standards

- Course contents can be tailored to your location and business needs

|

Read our Newcastle Building Society case study

Read our Aldermore bank case study

Delegate feedback

How to book

Reserve your place on one of our 3-day online courses

Speak to our team about a bespoke training course