Operating at the centre of the market gives us a unique vantage point to help maximise the returns from your debt sale strategy.

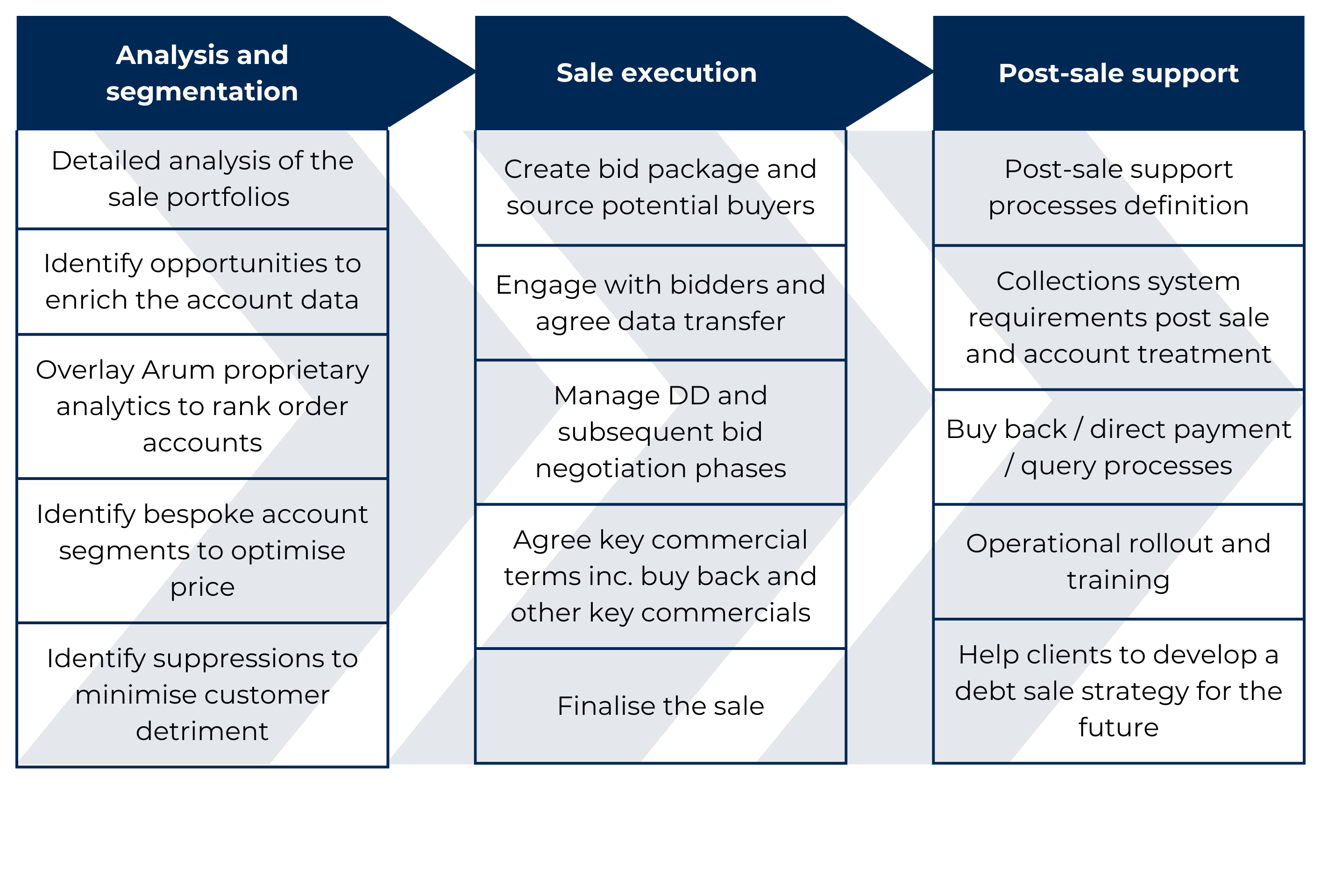

We can help you with all aspects of your debt sale strategy, managing your bid process end-to-end. From providing debt portfolio analysis, supplier engagement and selection, and commercial negotiation, through to contracting and setting up appropriate post-sale support processes, we ensure that you get the best outcomes from your debt sale.

Our experts have handled multiple debt sales in their careers. They have firsthand insight on enhancing the sale proceeds and ensuring good customer outcomes.

Discuss your needs with our team