Local authorities face greater challenges than ever to collect Council Tax and Business Rates. Arum and the IRRV have created a unique partnership that will provide you with a practical improvement plan to optimise your billing and collection service. Working with us will help you understand strengths of your service that you can build on, risks you should address, and opportunities for sustainable improvement.

What will we do?

Working with you and your team, we can review all aspects of your service, or focus on the elements most important to you. We will help you deliver two key outcomes:

What will you receive?

We will spend up to four weeks reviewing your Council Tax and Business Rates collections policies, strategies, processes, and organisational setup, following which you will receive:

- Confidential and candid advice about opportunities to improve your service

- Short, sharp and practical improvements that can be made in the short-term (quick wins) within the constraints of your current technology and investment resources

- Recommendations for long-term improvement and service transformation

- An outline plan broken into sensible work packages you can deliver yourselves or with support

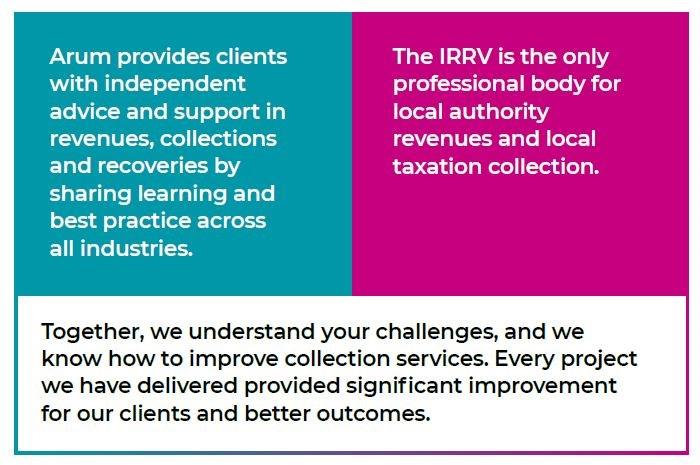

Why work with us?

The IRRV and Arum are the only partnership with qualified professionals who have hands on experience of delivering the entire Council Tax and Business Rates journey.

Find out more